The Importance of Professional Indemnity Insurance: 7 Practical Reasons

Running a business involves many potential risks associated with your services or advice, and protecting it from unforeseen circumstances is essential. If you are running a business across the Eastern suburbs of Melbourne, you should know the importance of professional indemnity coverage.

What is Professional Indemnity Cover

Professional Indemnity Insurance (PI insurance), or professional liability insurance, protects professionals from the financial risks associated with claims of professional negligence, errors, or omissions. This insurance cover provides financial assistance for legal defence costs and potential compensation payouts in the event of a professional indemnity claim.

Here are some reasons why you need Professional Indemnity Insurance for your business:

- Protection against legal claims: Professional Indemnity Insurance (PI insurance) protects professionals against legal claims arising from their professional services, such as advice or consultancy. It covers the cost of defending your business and paying any compensation awarded to the claimant.

- Financial protection: PI insurance can protect you from potentially catastrophic financial losses. A professional without adequate coverage can face personal liability for the damages awarded to the claimant, leading to a significant financial burden or even bankruptcy.

- Compliance with regulatory requirements: Many professions, such as doctors, lawyers, and accountants, require professional indemnity insurance as a mandatory requirement to maintain their professional licenses. This ensures that the professionals are held accountable for their actions and have adequate protection for their clients.

- Protection against errors and omissions: Even the most experienced professionals can make mistakes, and professional indemnity insurance can provide a safety net for such errors and omissions. This is especially important for businesses offering advice or services with significant financial consequences.

- Enhanced credibility: PI cover can enhance a professional’s credibility, demonstrating their commitment to providing quality services and willingness to take responsibility for their actions. This can be essential in building trust with clients and attracting new business.

- Protection against reputational damage: A professional indemnity insurance policy can cover the cost of restoring your business’s reputation in case of any claims or allegations of professional misconduct. This can be crucial for businesses that depend on their reputation to attract clients and stay competitive.

- Peace of mind: PI coverage can give you peace of mind by knowing that you are protected against any professional indemnity claims. It allows you to focus on your work without worrying about possible legal or financial consequences. It can also give your clients a sense of security, knowing that they are working with a responsible and reliable professional with their best interests at heart.

Professional Indemnity Insurance Cost

The cost of professional indemnity insurance depends on various factors, including the nature of your profession, the size of your business, and the level of coverage required. While the cost may vary, it is important to consider the potential financial consequences of not having professional indemnity insurance in place. The cost of a claim or legal defence can far outweigh the premiums you pay for PI insurance.

How Can CP Insurance Services Help You?

Choosing the right insurance policy can be confusing, especially if you’re unfamiliar with all the available options. That’s why it’s important to seek help from professionals who can guide you in making the right decision.

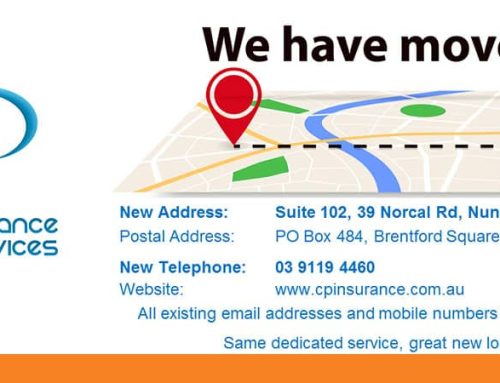

At CP Insurance Services, our team of experienced insurance brokers will take the time to understand your business and the level of coverage you require. We will then provide you with a range of options from our list of coverage plans so you can make an informed decision.

We at CP Insurance Services understand that each business is unique and offer tailored PI insurance policies to suit the specific needs of its clients. We provide a wide range of insurance products and we work with reputed insurance companies to ensure that you have the right level of protection. At CP Insurance Services, we pride ourselves on our exceptional customer service. We aim to make the insurance process as fast and stress-free as possible, so you can focus on running your business.

If you require professional indemnity insurance across the Eastern suburbs of Melbourne, contact CP Insurance Services today on 1300 884 698 or fill out our online form.

Leave A Comment