Like all other industries, the Insurance Market experiences pricing cycles. This is identified and defined as a Hard Market vs Soft Market. These descriptors relate directly to the premium levels and underwriting attitudes by Insurers. The two major factors that influence these two ends of the cycle are Natural Disasters and Economic Activity. During a soft cycle, underwriters have a relaxed underwriting approach and deliver low premiums. During a hard cycle, the reverse occurs with toughened underwriting approach and higher premiums.

Currently within Australia, the Insurance market is experiencing a hard market.

Comparison of the Insurance Markets.

Soft Market

- Lower insurance premiums;

- Discounts for Insurance provided;

- Broader coverage;

- Reduced underwriting criteria;

- wider acceptance of occupations and locations;

- Increased capacity, resulting in Insurers writing more policies and higher limits;

- Increased competition among Insurers.

Hard Market

- Higher premiums;

- Little to Nil discounts provided;

- Less coverage;

- Toughened underwriting criteria;

- Low acceptance of occupations and locations;

- Reduced capacity, resulting in less policies written;

- Decreased competition among Insurers.

Why are we experiencing a Hard Insurance Market?

A string of recent natural disasters, cyclones, floods and major storms to all regions of the country. Has seen Insurers pay the highest levels of claims seen in recent periods. In addition, economic activity has reduced significantly to several regions across Australia. Both these factors have combined to cause Insurers to reduce their exposure toward paying claims, increase insurance earn to build capital reserve.

Or in simpler terms increase premiums, lower claim payments

What can be expected during a Hard Insurance Market?

During a Hard Market, Insurer underwriting criteria becomes tougher and more stringent. Meaning they are less likely to provide insurance coverage to a business with a high-risk occupation or location.

Across the past 5-10 years, Insurers have increased the sophistication of their systems. This has allowed Insurers to more accurately map locations or regions that have high risk exposures.

These systems now permit Insurers to exclude suburbs or even streets from their acceptability criteria.

As Insurers move to reduce their exposure to certain regions. We will see more of these regions identified, with Insurers either increasing premiums substantially or decline to cover entirely.

Where in previous years, this has traditionally been applied to all regions in Far North Queensland and Northern Territory. These regions could be to be expanded to include further coastal regions of Queensland, Northern Western Australia and Northern Coastal NSW.

Claims experiences during a hard market.

The claims process can be tricky even at the best of times, but in a hard insurance market, challenges can become difficult.

A recent Gallagher report expresses how concerns of a hard market from Insurers usually goes hand in hand with Disrupted Claims Experiences. As Insurers question where claims costs are coming from and how they can be controlled or reduced.

As events continue to occur in Northern Australia, Underwriters are now scrutinising policies in areas that are prone to Natural Disasters. This increased risk is now being passed onto the consumer through inflated renewal premiums, placing stress on business owners.

The importance of an Insurance Broker during a hard market.

With more complex and contentious claims arising, along with shifts in Insurer underwriting approaches. Traditionally direct market Insurance products, become most affected.

Having a Broker working for your interests, ensures that despite changes by Insurers, your Broker is continuing to source the most competitive policy coverage and reliable claims service.

Having a Broker that you can rely and trust upon during tough market conditions, becomes the difference of spending weeks upon weeks fighting an Insurer, vs being able to continue operating your business and getting the result that you deserve.

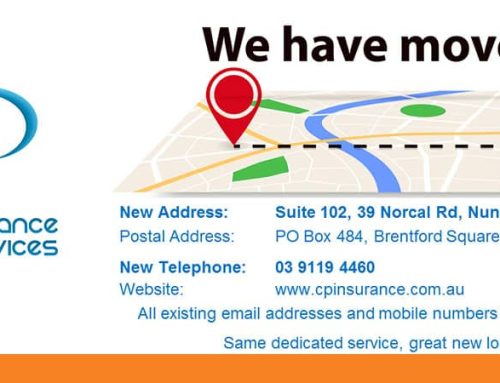

For more information or questions upon how a hard insurance market may affect your business, contact CP Insurance Services on 1300 884 698.