Who Needs Professional Indemnity Insurance?

In today’s complex business landscape, authorities across various industries face potential risks that could lead to legal claims. In such scenarios, professional indemnity insurance safeguards individuals and businesses against accusations. This type of insurance protects against negligence claims, poor service delivery, or omissions in their services. It is vital for those working as consultants, healthcare providers, and other service-oriented practitioners.

To protect one’s reputation and finances, understanding the key benefits of professional indemnity insurance becomes important. In this blog, we will explore who needs this insurance, what it covers, and why it is necessary.

What is Professional Indemnity Insurance?

This insurance protects businesses and professionals against claims made by clients alleging negligence or poor service. If a client suffers financial loss due to your advice or actions, this insurance covers legal costs and any compensation that may be required. It’s a critical safety net for professionals whose services carry financial risks for their clients.

If you are wondering “Do I need professional indemnity insurance for my business?”, you are in the right place. For high-stakes fields such as consulting, healthcare, and law, where reputation is on the line, this coverage is not just a requirement – it is a necessity. It provides peace of mind, allowing you to focus on your work without worrying about potential legal claims.

What Types of Sectors Need Professional Indemnity Insurance?

Professional indemnity insurance is important for industries where expert services or advice are provided. Without this coverage, businesses face significant risks if clients make claims related to unsatisfactory work or errors that result in financial loss. This insurance helps avoid costly legal proceedings and compensation payments.

Here are some of the sectors that benefit from professional indemnity insurance:

- Marketing Specialists

- Architects

- Engineers

- Healthcare Providers

- Legal Advisors

- Accountants

- IT Professionals

- Real Estate Agents

- Bookkeepers

What Does Professional Indemnity Insurance Cover?

Even the most skilled professionals can make mistakes, and that’s where professional indemnity insurance becomes very helpful. It covers legal costs, missed deadlines, and other errors in your work that may lead to financial loss for your clients.

Regardless of your industry, there is always a chance of a claim against your services. This insurance helps cover the financial costs of legal defence, compensation, and settlement. It also protects your professional reputation by enabling you to defend your services without admitting fault just to avoid high costs. Professional indemnity insurance takes care of the following:

- Legal Liability

- Defence Costs

- Civil Liability Claims

- Retroactive Coverage

- Loss of Documents

- Breach of Confidentiality

- Libel and Slander

- Court attendance costs

These are handled effectively so you can focus on work without any economic strain.

Why Should I Get Professional Indemnity Insurance?

Obtaining professional indemnity insurance is essential for protecting your business against possible legal claims. Even small mistakes can result in costly lawsuits, and having this coverage helps shield you from financial setbacks. Clients often expect or require you to have this before they’ll work with you. It shows you’re responsible and prepared.

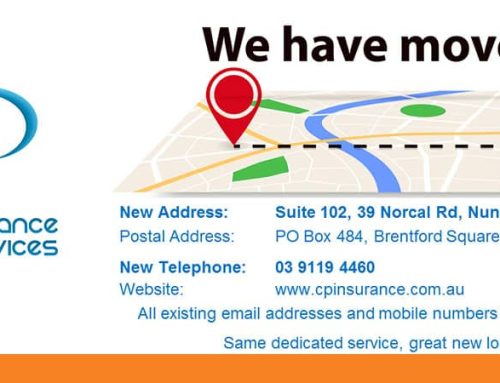

A professional indemnity insurance broker in Melbourne, such as CP Insurance Services, can assist you in finding the right policy that suits your specific needs.

We partner exclusively with Australian Authorised Insurers, thus guaranteeing comprehensive coverage tailored to your needs. Being an award-winning company, our team helps you find the most competitive balance between coverage and premium, maximising your savings. So, don’t leave your reputation and finances vulnerable. Contact CP Insurance Services today for some peace of mind. Call us on 1300 884 698 or fill out our online contact form and we will be in touch.

Leave A Comment